Education Tax Credits

Did you know that you can redirect your PA state taxes owed to significantly improve the education and success of at-risk youth in Harrisburg?

For over 20 years The Joshua Group has been offering an array of “cradle-to-career” programs and services funded by businesses and individuals through Education Tax Credits (SPE Program). Our high school graduation rate is 97%...45% higher than public school.

HOW?

Apply for Education Tax Credits through Pennsylvania’s EITC/OSTC Programs

WHO CAN GIVE?

Businesses and Individuals can give through our Special Entity Program (SPE)

FIND OUT MORE

Watch this video to find out more about Education Tax Credits and how SPE works…

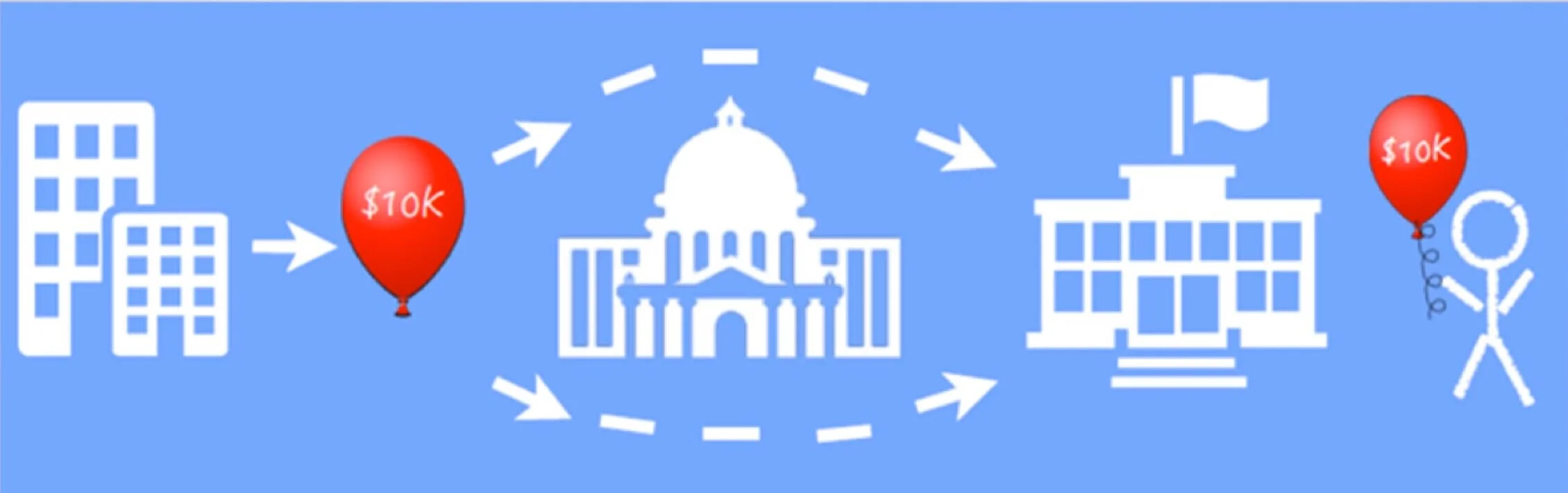

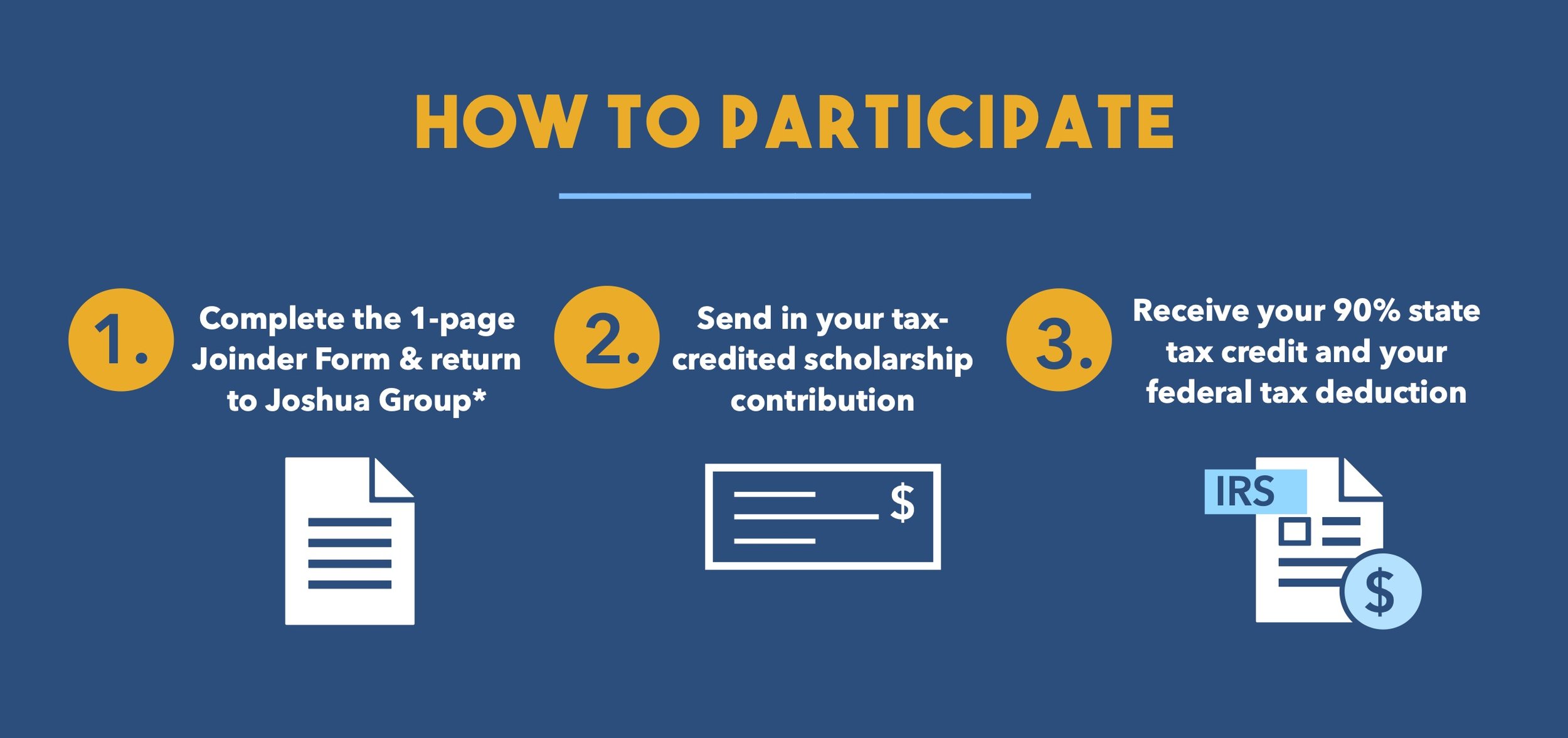

EITC/OSTC GIVING ILLUSTRATION

A donor can give $10,000 to a school scholarship program for approx. $650 out of pocket AND control how and where their state dollars are spent.**

**A taxpayer single/combined owes the state $10,000 in tax.

**With EITC/OSTC, if the taxpayer joins the education tax credit Special Purpose Entity (SPE) for the full amount of the state tax liability, 100% goes to the school of their choice and they receive a $9,000 state tax credit.

**The taxpayer can deduct the remaining $1,000 of the gift on their federal tax return.

“It was empowering to join an SPE to provide a Joshua Group student scholarship. I am so happy that more children can receive a quality education because I am free to redirect my PA Tax dollars to a school.”

For more information on the SPE, EITC, and OSTC programs, please contact:

Jeannetta Politis, Executive Director - j.politis@joshuagrouphbg.org 717-236-4464